If you are interested in gemstones with other parameters, we invite you to contact our hotline and advisors in our branches. Contact details are available in the Contact section.

Diamonds are the most precious gemstones. Despite this, they not only complement the collections of the wealthiest but also of all those who want to invest in a safe product that perfectly protects capital, including during times of inflation. The uniqueness of diamonds and their growing popularity largely stems from the uniqueness of each individual specimen. Only an experienced cutter can give gemstones an exceptional shape so that light penetrates their interiors and reflects off the walls in an almost magical way. It is from these full beams of reflections that diamonds are famous, which after being cut with an appropriate number of facets are called brilliants.

These stones as investment products represent a safe capital investment for many years. Diamonds are timeless and transnational, but their most important advantage is their mobility - diamond rings sometimes reach the value of a single-family home, yet they can be hidden in a pocket and easily carried around the world with one's wealth at hand. The mission of the Treasury Mint is therefore to complement the investment portfolios of Poles, becoming, alongside precious metals, the best possible way to diversify the security of one's own resources!

Diamond, the hardest of gemstones

The uniqueness of diamonds stems from their extraordinary, almost delicate appearance. However, this delicacy has no relation to the durability of these gemstones, which are considered the hardest minerals occurring in nature (10 on the Mohs scale). Diamonds are made of carbon atoms and were formed billions of years ago under conditions of high pressure and enormous temperatures. It is therefore difficult to find two identical specimens, especially since their final shape is given by trained cutters. Thanks to them, the market is filled today not only with jewelry diamonds but also with investment diamonds available to everyone!

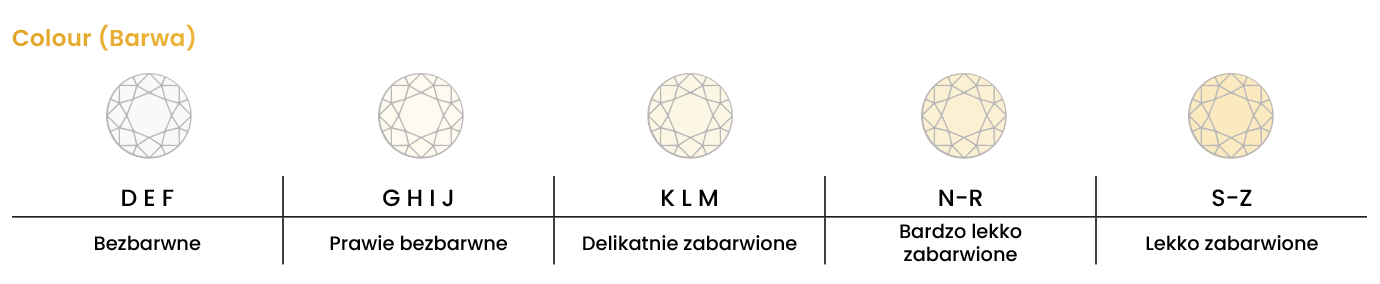

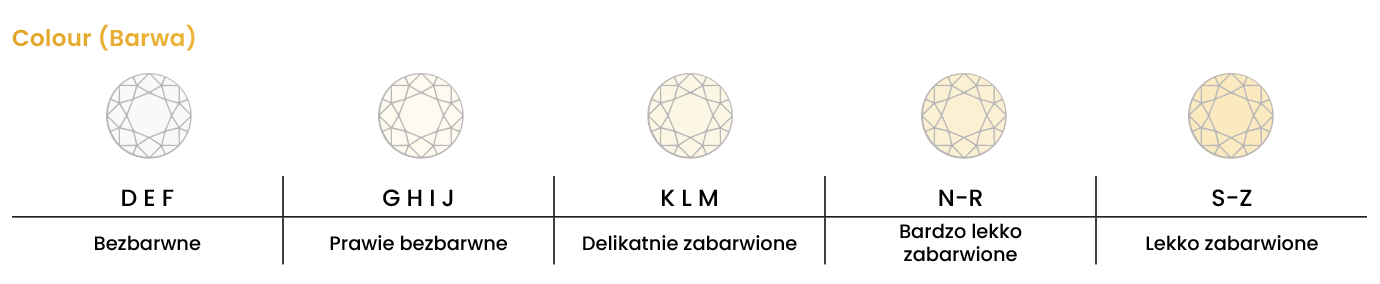

Colored and colorless diamonds

At first glance, diamonds may differ in cut and size. It is also worth paying attention to color. Among investment diamonds, one can distinguish: colored diamonds and colorless diamonds. For the latter, a scale with designations from D to Z is used, where: letters D-F indicate colorless diamonds; letters G-J describe near-colorless diamonds; letters K-M describe tinted diamonds; and letters N-Z describe yellowish diamonds. As for colored gemstones, according to the Fancy Color Research Foundation, they constitute a smaller part of the market. However, due to their beautiful appearance, their popularity is growing. Colored diamonds take on shades of green, red, purple, blue, or yellow, of course while retaining their reflectivity!

Types of investment diamonds – the 4C principle

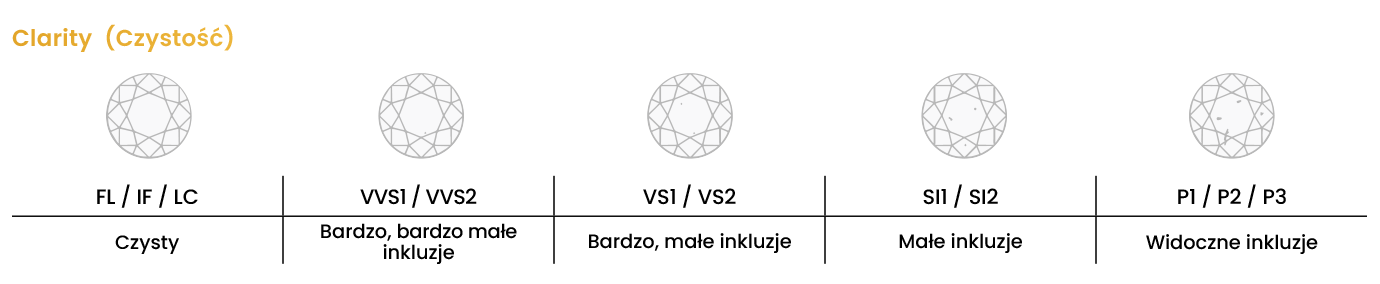

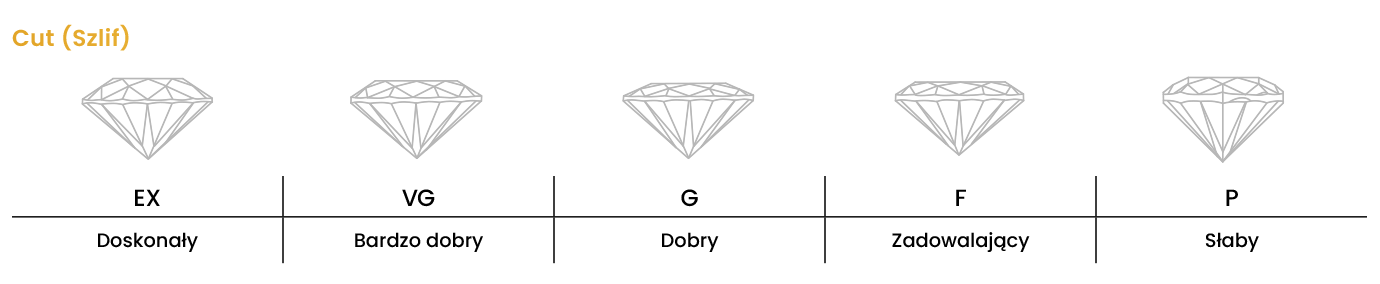

When purchasing investment diamonds, one should be guided by the 4C principle, which refers to four important physical parameters of a given diamond specimen! These are:

1. Color – the most important parameter in assessing the value of colorless diamonds and fancy color diamonds.

2. Carat Weight – a diamond's carat specifies its mass, i.e., 1 carat (ct) is 0.2 grams. Among popular investment diamonds, one can distinguish stones with designations: .18; .25; .50; .75; 1.00; 2.00; 2.50; and also 2.99.

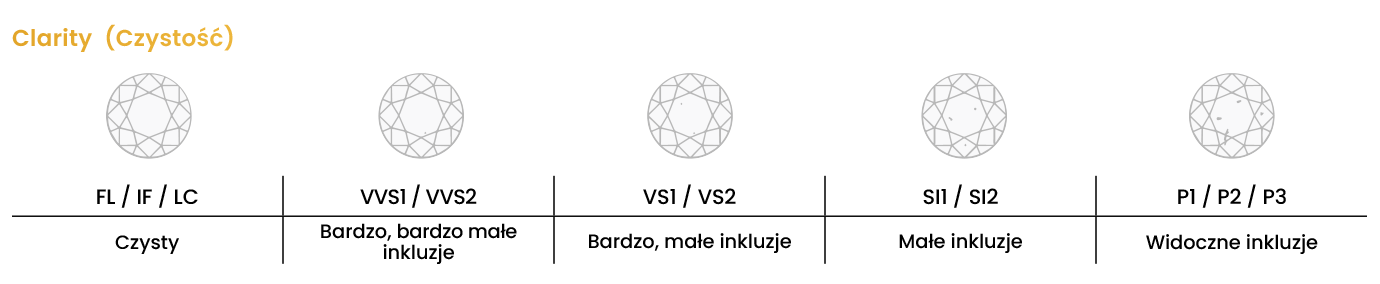

3. Clarity – diamonds may contain minor imperfections, and their level is determined by the clarity scale. Stones almost free of flaws are called "Internally Flawless" IF. Those with significant flaws are termed "Imperfect" P1, P2, P3.

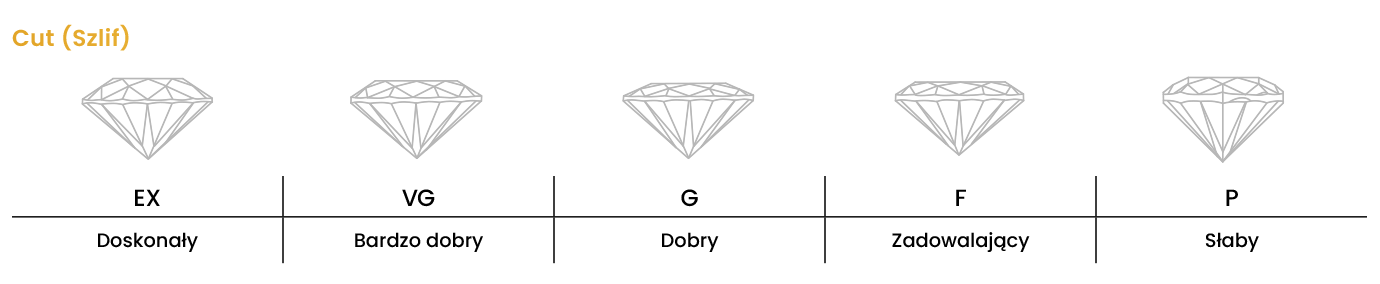

4. Cut – this refers to the proportion, symmetry, and polish of the diamond. It is thus not a parameter related to shape but to the diamond's interaction with light falling on its surface!

Additionally, an important parameter of investment diamonds is the shape itself. More fanciful shapes are reserved for the jewelry industry, but it is worth highlighting the following – commonly encountered – diamond shapes: brilliant (the most popular shape), teardrop, oval, marquise, triangle, princess, baguette, cushion, asscher, octagon, emerald, and heart.

Monte Carlo Diam investment diamonds

The investment diamonds forming the diamond portfolio of the Treasury Mint come from a recognized entity in the world: the company Monte Carlo Diam, which holds all necessary licenses for trading colorless diamonds and for the wholesale distribution of colored diamonds. Cooperation with this diamond supplier is a guarantee of the authenticity of the gemstones!

A few words about Monte Carlo Diam

Monte Carlo Diam is a company founded on July 16, 2013. From the beginning of its operations, it has had offices at the Antwerpsche Diamantkring. The company stands out with its base of designers and producers of diamonds in Belgium, the United Kingdom, Poland, and France. It is also one of the main suppliers of colored diamonds to the markets of Eastern Europe. Monte Carlo Diam is personally connected with Poles!

Authenticity of investment diamonds

The company Monte Carlo Diam ensures the authenticity of colorless and colored diamonds by cooperating with certified institutions. They issue for each specimen an individual certificate with a unique number and a precise description of the stone's parameters. Everything is also overseen by the World Federation of Diamond Bourses WFDB, to which our business partner Monte Carlo Diam belongs. As for certification centers, the following entities must be highlighted: Gemological Institute of America (GIA), International Gemological Institute (IGI) - the most popular in Europe, HRD Antwerp - Hoge Raad voor Diamant (HRD).

Stable value of investment diamonds

The value of investment diamonds is stable and still growing. It is no wonder that these gemstones are eagerly chosen by investors today. It should be emphasized that diamond prices generally start from around 1500 złoty, and the most expensive products intended for investment cost even several tens of thousands of złoty. The value of diamonds is primarily determined by the 4C parameters. Furthermore, the reputable Rapaport Price List operates in the market, which is a wholesale price list for colorless diamonds published every Thursday. It is created by the Rapaport Group, operating in 118 countries and serving over 20,000 clients!

Why invest in diamonds?

Diamonds have seen a significant increase in their value since the beginning of the economic crisis and the soaring inflation rates of world economies. Investing in them guarantees stability, but above all, it is appreciated by investors due to the ease of carrying and mobility. This makes them a practical asset in situations where moving wealth is necessary. Buying diamonds is thus an excellent way to expand one's investment portfolio and protect capital in unstable times. Investing in gemstones is a perfect alternative to buying investment gold and silver. Diamonds are also worth considering as a complement to one's collections of precious metals!

Online diamond sales with shipping

The Treasury Mint offers online diamond sales with secure shipping. Clients can also personally pick up ordered gemstones in our branches located in the largest cities in Poland. We also encourage you to take advantage of the knowledge of our specialists, who recommend, among other things, diamonds as gifts!

We inform you that our diamonds are available in two forms of sale. The first option is diamonds sold in CertiPack packaging, which ensures the safety and authenticity of the stones. The second option is purchasing loose diamonds, packed in cardboard boxes. We offer a wide selection to meet the diverse needs of our clients. Please note that information regarding the type of packaging is included in the product specification.

Start investing in diamonds today!

We kindly inform you that goods imported according to the customer's specifications, on individual order, are not subject to the right of withdrawal from the contract under the Consumer Rights Act.

801 501 521

801 501 521